does california have an estate tax or inheritance tax

The state of California does not impose an inheritance tax. 8 hours agoAccording to IRS data in 2019 the most recent year for which data is available more than 86000 pass-through business owners filed under the individual income tax system.

California Prop 19 Property Tax Changes Inheritance

In other words California does not have inheritance tax or state-level estate tax.

. If you are a California resident you do not need to worry about paying an inheritance tax on the money you inherit from a. California has no estate tax for individuals who died on or after January 1 2005 and has no inheritance tax. California has neither its estate tax nor an inheritance tax.

This means that if someone from San Francisco inherits real estate from someone who lived in Los Angeles then. For decedents that die on or after January 1 2005 there is no longer a requirement to file a. It is typically assessed by the state where the beneficiary or heir lives and resides.

The estate tax is paid out of the estate so the beneficiaries will not be liable for paying the estate tax technically speakingalthough it would deplete the amount left in the. Does California Have an Inheritance Tax or Estate Tax. The information below summarizes the filing requirements for Estate Inheritance andor Gift Tax.

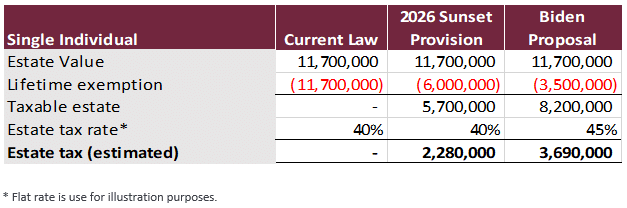

Estate taxAs the grantor or bequeather paying estate taxes is your responsibility not the heirs or beneficiaries. Even though California does not have its own estate and inheritance taxes it is still one of the highest tax states in the country. Individuals unrelated to a deceased person however tend to be subject to inheritance tax.

In California retirement accounts and pension plans are. The states government abolished the inheritance. For most individuals in California this is no longer a major concern.

Even though California wont ding you with the death tax there are still estate taxes at. But the good news is that California does not assess an. There is no California inheritance tax.

Wisconsin does have several tax credits available. California currently does not have a state inheritance tax. Earned income tax credit worth up to 13 of your federal earned income tax credit.

Homestead tax credit towards up to 1168. Certain states only impose an inheritance tax. Californias newly passed Proposition 19 will likely have major tax consequences for individuals inheriting property from their parents.

The federal gift and estate tax is a tax that is imposed by the federal government on all qualifying gifts made by a taxpayer during hisher lifetime and all. The Federal Gift and Estate Tax. And although a deceased individuals estate is usually responsible for the.

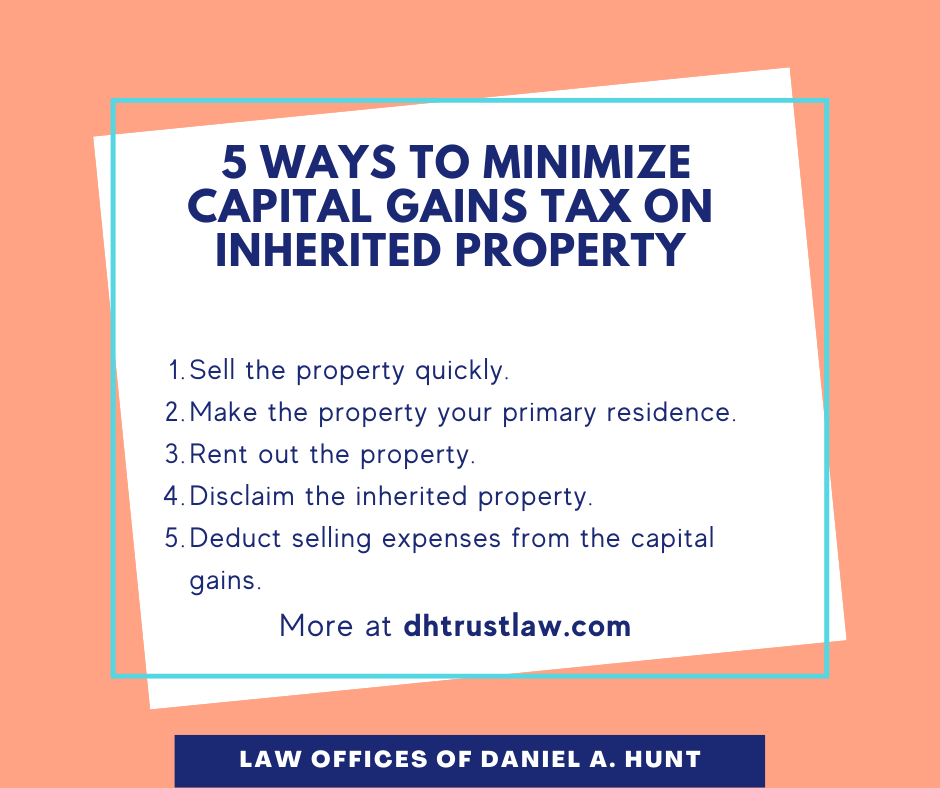

They will not need to pay an income tax on the. In short the beneficiaries and heirs will be able to inherit the property free of taxes. Proposition 19 was approved by.

California does not have an estate tax so probate is generally spent verifying the validity of the will and confirming who will act as executor of the estate. Californias estate tax was phased out over four years starting in January 2002 and culminating in the total. In California there is no state-level estate or inheritance tax.

California residents are not required to file for state inheritance taxes. California tops out at 133 per year whereas the top federal tax rate is currently 37. California residents dont need to worry about a state inheritance or estate tax as its 0.

California estates must follow the federal estate tax which taxes certain large estates. In California anything that you receive as an inheritance is not subject to tax.

Inheritance Tax Archives South Bay Elder Law

Does California Have An Inheritance Tax Sfvba Referral

California Estate Tax Everything You Need To Know Smartasset

States With Estate And Inheritance Taxes

It May Be Time To Start Worrying About The Estate Tax The New York Times

What Is Inheritance Tax Probate Advance

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated And Who Pays It

There Is No California Inheritance Tax Los Angeles Estate Planning Attorneys

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Federal Gift Tax Vs California Inheritance Tax

Avoid Capital Gains Tax On Inherited Property Law Offices Of Daniel Hunt

California S Tax On Inherited Properties Hurts Minority Communities Calmatters

California Estate Tax Is Inheritance Taxable Income

States With No Estate Or Inheritance Taxes

State Estate And Inheritance Taxes Itep

210 Tax Treats Ideas In 2022 Tax Internal Revenue Service Irs

Will My Heirs Be Forced To Pay An Inheritance Tax In California

Estate Tax Current Law 2026 Biden Tax Proposal

Here S How Taxes Work On Estates And Inherited Money Los Angeles Times