nc sales tax on prepared food

The Food and Beverage tax rate for Dare County is 1 of the sales price of prepared foods and beverages sold within the county for consumption on or off a premises by a retailer who is subject to sales tax under GS. But youd only charge the uniform reduced rate of 2 local tax on the loaf of bread.

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Who Should Register for Sales and Use Tax.

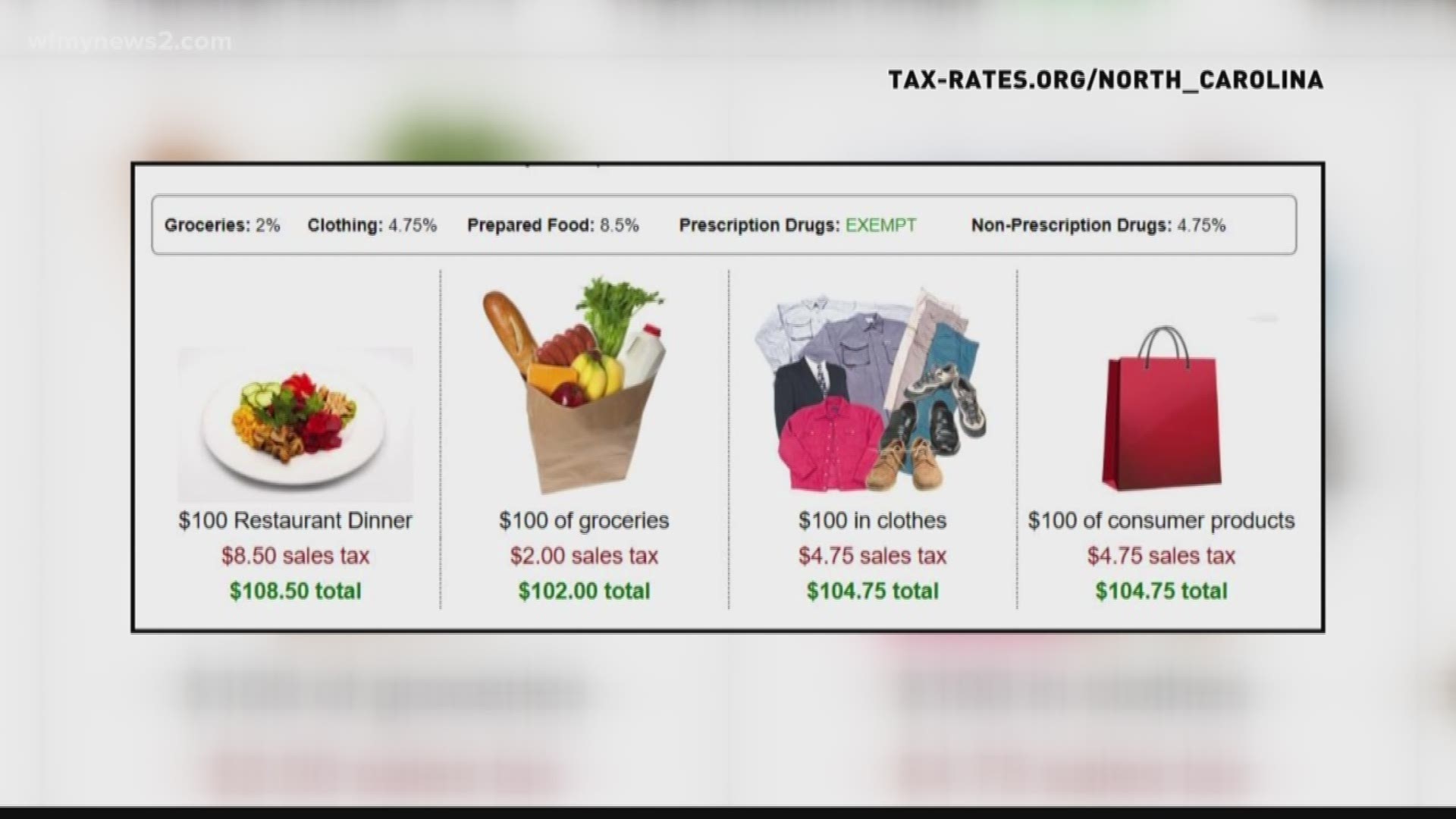

. North Carolinas sales tax rates for commonly exempted categories are listed below. Some rates might be different in Mecklenburg County. North Carolinas sales tax rates for commonly exempted categories are listed below.

Prepared Food Beverage Division. Wake County Tax Administration. The Watauga County North Carolina sales tax is 675.

Food Non-Qualifying Food and Prepaid Meal Plans. One percent 1 of the sales derived from prepared food and beverages sold is assessed at retail for consumption on or off the premises are assessed by any retailer within the County that is subject to sales tax imposed by the State of North Carolina. North Carolina Department of Revenue.

105-164328 and reads as follows. PO Box 25000 Raleigh NC 27640-0640. This tax is in addition to State and local sales tax.

Prepared Meals Tax in North Carolina is a 1 tax that is imposed upon meals that are prepared at restaurants. 75 is the highest possible tax rate cedar grove north carolina the average combined rate of every zip code in north. Skip to main content Menu.

FilePay Sales and Use Tax E-500 Pay a Bill. Note that in some areas items like alcohol and prepared food including restaurant meals and some premade supermarket items are charged at a higher sales tax rate than general purchases. Lease or Rental of Tangible Personal Property.

Lease or Rental of Tangible Personal Property. PO Box 25000. A 1 tax is applicable to all prepared food and beverages sold at retail for consumption on or off the premises and applies to any retailer with sales in Cumberland County subject to sales tax imposed by the State of North Carolina under NCGS.

A person firm or corporation or association who fails or refuses. Nc sales tax on food items. Counties and cities in north carolina are allowed to charge an additional local sales tax on top of the north carolina state sales tax.

Penalty for Late Payment. While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Groceries and prepared food are subject to special sales tax rates under North Carolina law.

To learn more see a full list of taxable and tax-exempt items in North Carolina. Thereto levy a prepared food and beverage tax of up to 1 of the sales price of prepared food and beverages sold within the town at retail for consumption on or off the premises by a retailer subject to sales tax under General Statute 105-1644a1. Taxation of Food and Prepared Food.

Aircraft and Qualified Jet Engines. This prepared food and beverage tax is in addition to any North Carolina or local sales tax A return filed with the Mecklenburg County Office of the Tax Collector under this Ordinance is not a public record as defined in Chapter 132-11b of the North Carolina General Statutes and may not be disclosed except as. Certain purchases including alcohol.

Some rates might be different in Pitt County. Laundries Apparel and Linen Rental Businesses and Other Similar Businesses. For assistance in completing an application or questions regarding the Prepared Food and Beverage tax please call the Wake County.

North Carolinas sales tax rates for commonly exempted categories are listed below. The provision is found in. General Sales and Use Tax.

A customer buys a toothbrush a bag of candy and a loaf of bread. This page describes the taxability of food and meals in North Carolina including catering and grocery food. Note that in some areas items like alcohol and prepared food including restaurant meals and some premade supermarket items are charged at a higher sales tax rate than general purchases.

Sales Use Tax. Sales and Use Tax. A 1 tax is applicable to all prepared food and beverages sold at retail for consumption on or off the premises and applies to any retailer with sales in Cumberland County subject to sales tax imposed by the State of North Carolina under NCGS.

The tax is only imposed by local jurisdictions upon the granting of approval by the North Carolina General Assembly. How can we make this page better for you. North Carolina Department of Revenue.

According to North Carolina law youd be required to charge the full Murphy NC sales tax amount of 7 475 NC state rate and 225 Cherokee County rate on the toothbrush and the candy. Overview of Sales and Use Taxes.

Flush States May Exempt Food From Sales Tax

Sales Tax On Grocery Items Taxjar

Is Food Taxable In North Carolina Taxjar

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Craft Fairs And Sales Tax A State By State Guide

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

Is Food Taxable In North Carolina Taxjar

Exemptions From The North Carolina Sales Tax

Is Food Taxable In North Carolina Taxjar

Sales Tax On Groceries Sales Tax Data Link

Is Food Taxable In North Carolina Taxjar

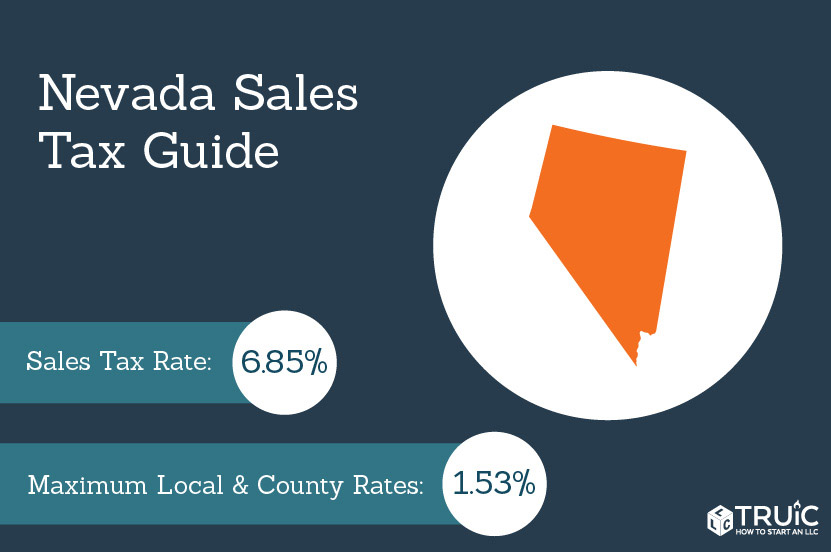

Nevada Sales Tax Small Business Guide Truic

E 500 Sales And Use Tax Return

Sales Tax On Grocery Items Taxjar